Rivian Stock: 1.4x Sales Multiple After Adjusting For Cash (NASDAQ:RIVN)

Michael M. Santiago/Getty Illustrations or photos News

In current months, electrical-auto stocks have underperformed. No matter whether it really is Rivian Automotive, Inc. (NASDAQ:RIVN), Lucid Motors (LCID), or Nikola Company (NKLA), the electric-car sector has missing some of its attract as a end result of a crippling offer-chain situation. This loss of attractiveness may possibly also provide determination for investing in overwhelmed-down electric-vehicle startups such as Rivian Automotive.

In my viewpoint, the electrical-auto maker has the most affordable production hazards in the industry, thanks to a huge $16.4 billion hard cash pile that now accounts for 65% of the firm’s sector price. Rivian Automotive’s inventory is attractively valued ex-funds.

Rivian Automotive’s Production And Pre-Purchase Position

Rivian Automotive affirmed in May that its earlier manufacturing forecast of 25K models in 2022 continues to be unchanged. In March, the EV manufacturer minimized its output forecast from 50K to 25K cars because of to continued source-chain concerns. Rivian Automotive’s affirmation of the 25K unit manufacturing target lowers challenges for the EV business, as there was a threat that supply-chain challenges would have deteriorated to the stage exactly where administration would have decreased its production advice yet again.

Rivian has in excess of 90K pre-orders from clientele in the United States and Canada as of May 9, generating a significant purchase backlog that will probably choose the company a lot more than two years to perform by means of. Despite elevating electrical-auto pricing by up to 20% in March, Rivian Automotive was in a position to insert 10K R1 pre-orders, demonstrating that greater rates do not deter purchasers.

Rivian Automotive also uncovered the variety of cars produced and delivered in 1Q-22, in addition to confirming the 2022 manufacturing forecast. Rivian Automotive crafted 2,553 electric powered-motor vehicles in 1Q-22 and delivered 1,227 of them for $95 million in sales.

Rivian Automotive created virtually 5K electrical-cars throughout two auto platforms considering the fact that the start out of production, which is much more than double the amount created on March 8, when Rivian Automotive claimed it made a full of 2,425 electric powered-automobiles.

What will be most essential to Rivian Automotive in the potential is its skill to expand creation quickly. The EV firm intends to create 600K electric-cars for every calendar year, which include the R1T, R1S, and EDV. The EDV is out there in two sizes: the EDV 700, which is meant to be the workhorse of Amazon’s delivery fleet, and the EDV 500, which is a smaller variant.

Rivian Automotive’s production capability is envisioned to improve appreciably above the following two to three a long time as the EV producer focuses the manufacturing and delivery ramp of its numerous models. Rivian Automotive presently has an set up generation capability of 150K models in Illinois, but plans to boost annually output to 1 million electrical-motor vehicles by the end of the ten years.

Economic Benefits For 1Q-22

Rivian Automotive is getting rid of income like ridiculous, but that is to be anticipated. The business is now concentrating on increasing R1T, R1S, and EDV generation and doing the job through generation hiccups to operate its manufacturing unit more proficiently in 2022.

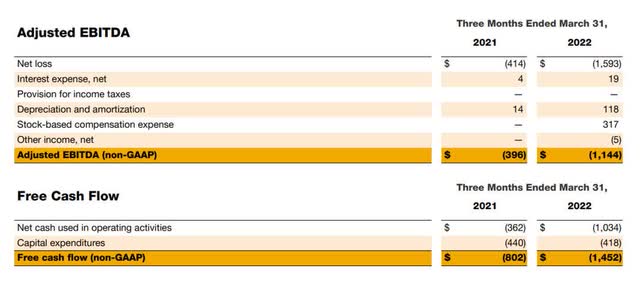

Irrespective of major losses, Rivian Automotive’s success are anticipated to enhance substantially in 2023. Rivian Automotive’s decline on an modified EBITDA basis in 1Q-22 was 4 times that of the prior calendar year. Even so, as manufacturing ramps up in 2H-22, traders need to commence to recognize sizeable revenue implications. Rivian Automotive’s revenues are envisioned to climb 252% to $6.47 billion subsequent year, according to the market.

Modified EBITDA (Rivian Automotive)

Rivian Automotive’s Low Possibility Stems For Its Excellent Harmony Sheet

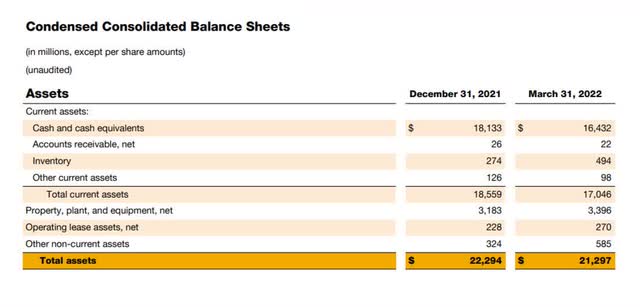

What EV company do you know that has far more than $16 billion in dollars lying on its harmony sheet, waiting around to be used? Accurately.

Rivian Automotive’s massive funds reserves let the EV organization to increase generation without having stressing about increasing further funding from investors, which I imagine is turning into additional hard now that the U.S. economic climate is on the verge of a disaster and buyers are increasingly threat-averse.

Apart from getting a lot more than enough dollars to support the scaling of manufacturing and deliveries, Rivian Automotive’s equilibrium sheet dollars of $16.4 billion signifies an extraordinary 65% of the company’s sector price.

Condensed Consolidated Balance Sheets (Rivian Automotive)

Rivian Automotive has all over $18.24 per share in funds, leaving $9.76 for every share to worth the firm’s worthwhile EV operations (facilities, support and distribution network, IP, etc.). Based mostly on 901 million course A and course B shares outstanding, the cumulative equity worth of Rivian Automotive’s operations is hence $8.8 billion.

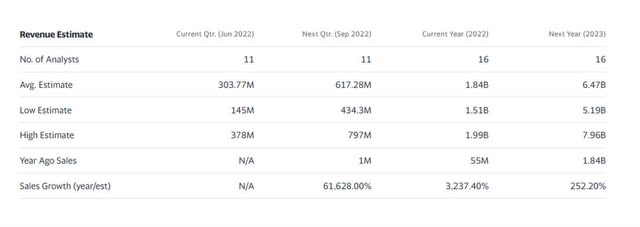

Rivian Automotive has a revenue various of 1.4x, altered for the company’s appreciable money resources, with anticipated 2023 income of $6.5 billion. A sales various of 1.4x is minimal for an electric powered-auto organization that is predicted to mature by 252% upcoming 12 months, according to the market place. Rivian Automotive has a profits various of 3.9x with no a income adjustment.

Profits Estimate (Rivian Automotive)

Why Rivian Stock Could Fall

Provide-chain challenges and inflation are two of the most regarding elements of developing an electric powered-car or truck agency. So much, better device prices and lengthier waiting lists have not deterred people, and the point that the enterprise included 10K fresh pre-orders to its reservation lists indicates that Rivian Automotive’s EVs are in higher demand from customers. A larger-than-expected economic slowdown and increasing element costs could scare investors absent from the electrical-motor vehicle sector, in which most corporations are even now shedding revenue.

My Conclusion

Rivian Automotive’s stock value has dropped in 2022, but the agency is building headway in increasing generation capacity, and rate raises have not dampened buyer fascination or demand. Rivian Automotive’s financial institution sheet and money strength established the business apart from competitors who ought to boost manufacturing with significantly fewer means.

Rivian Automotive might be the EV company with the most probable and the minimum total of threat due to the fact it is only at the starting of its multi-calendar year route to turn into a world wide chief in the electrical-car or truck market place.