REE Automotive: Building A Platform To Ride Growing Demand

assalve/E+ via Getty Images

Hastening the EV transition carries on to variety a main tenet of the thrust by policymakers to lower oil demand from customers. This has most not long ago witnessed the European Union endorse a framework to stop new inside combustion engine car or truck product sales by 2035. This sites the union on a prolonged checklist that incorporates the United Kingdom, Norway, South Korea, and California. The aim is crystal clear, wipe out oil demand from customers right to deal with weather fears. An aim bolstered if the electricity then comes from renewables, nuclear electrical power, and decrease-carbon natural gas.

REE Automotive (NASDAQ:REE) is establishing a rolling chassis for professional electrical motor vehicles. This will incorporate the REEcorner, an integration of all important car components (steering, braking, suspension, and powertrain) into the arch of the wheel. REE is essentially supplying OEMs a platform they can use as a foundation for their EVs. The corporation sees by itself as a select-and-shovel enjoy on mounting EV need from business clients. This arrives on the back again of rising tension on companies to embed better sustainability into their operations. By utilizing REE as a system, these companies can lower their time-to-current market, comply with zero-carbon rules, and lessen their full expense of ownership.

Going Community To Journey The EV Wave

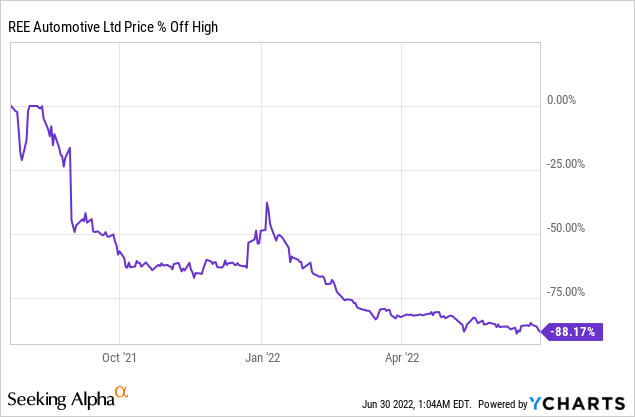

REE went public by a merger with a blank examine business in July of 2021. The fledgling EV corporation did so to increase $288 million of gross proceeds in a transaction that was accomplished at a $3.1 billion valuation.

The valuation has since declined by 88% from all-time highs to $418 million as the unrestrained euphoria that outlined the EV SPAC growth has presented way to a additional pragmatic thought of the pre-earnings EV organization. And although REE has relatively of a market strategy to focus on the wave of decarbonization sweeping across the world, its management maintains that they are concentrating on a $700 billion overall addressable industry. The technique to current market an EV platform specifically to OEMs is exclusive among its business EV SPAC peers. Other lately general public business EV organizations like Arrival (ARVL), Cenntro Electric (CENN), and Lion Electric (LEV) are all constructing their personal EV versions to market instantly to the exact same prospects getting qualified by REE.

The organization a short while ago declared earnings for its fiscal 2022 very first quarter and mainly shared operational updates in its push toward entire commercialization. REE ongoing to establish associations with new companions such as EAVX with whom REE is jointly producing a walk-in move van prototype. The class 5 car or truck prototype is predicted to start off purchaser evaluations this summer season with the Begin of Manufacturing and deliveries on keep track of for 2023. GAAP internet decline was $23. million in the to start with quarter, up from $12.6 million very first quarter of 2021.

REE reiterated its fiscal year steerage for operating expenditures to complete concerning $100 and $120 million, mostly pushed by engineering and technological know-how charges associated to its commercialization attempts. The firm’s cost-free income flow for the quarter was destructive at $38.4 million, up considerably from $6.5 million in the year-back time period. This is to be predicted as the organization commences to ramp up its testing and the expansion of its market footprint as it developments to its 2023 commercialization timeline. Sentiment in the house has turned south with dwindling money balances and likely worry possibility now getting additional widespread than in 2021. The personal bankruptcy of Electric Previous Mile has reverberated all over the sector, highlighting the great importance of a big money balance in helping these upstarts survive the expected economic problems.

REE held funds and equivalents of $239 million, down sequentially from $275.8 million in the preceding quarter as money burn extra than doubled around the exact period. Using the foundation assumption that this amount of melt away stays constant, the firm has a runway that extends past a fiscal 12 months. REE is unlikely to have started off building constructive dollars movement in 6 quarters but its runway is even now comparatively extensive. This bodes properly for potentially elevating hard cash in an environment where sentiment has enhanced.

Desire Destruction Whilst Keeping Financial Progress

There is undeniably a prolonged-phrase change in transportation occurring across the world as ICE vehicles are changed by their EV choices. This is generating a sizeable decarbonization wave that could drive demand for REE’s system technological innovation in the decades forward. REE is concentrating on a big and expansive market place with a unique method that sets the enterprise up as a decide-and-shovel participate in on the expansion of this macrotrend.

That explained, the competition is extremely capitalized and also ramping generation to meet envisioned need. This produces some uncertainty all around whether the commercial EV industry will be able to guidance all these companies in its vital early stage. REE is just one to insert to your watchlist and could be regarded as a buy only when they set up strong industrial traction.